Happy New Year! Another year has passed, and a fresh one is now upon us. As we enter into 2023, I want to lay out some of the main regulatory issues (some new and some old) I’ll be tracking over the next year that affect you as emergency physicians and your patients. While these may change over the course of the year (or even a few days after I write this), I still think they are important to flag for the time being – and I will be continually be updating you on these throughout the next several months.

The End of the COVID-19 PHE

After three years, the major question is: will the COVID-19 public health emergency (PHE) finally come to an end and, if so, when? It is currently set to expire next week on January 11, but it will likely be extended again for 90 days until April 11. After that… who knows!

Once it expires, some of the flexibilities that Congress and federal agencies, including the Centers for Medicare & Medicaid Services (CMS), will end. Other flexibilities, however, follow a different timeline, thanks to recent action from Congress. As you read in last week’s blog by Ryan McBride, Congress enacted provisions related to some of these flexibilities, including telehealth and Medicaid coverage, in the major omnibus bill – the Consolidated Appropriations Act, 2023. The President signed the bill into law last week on December 29.

Telehealth

Given the recent Congressional action, the timeline of how long all the telehealth flexibilities will last is pretty confusing, so I’ll try to lay it out clearly (including a handy table!). Some of the timeline may change over the course of the year as well.

Let’s say the PHE ends on April 11, 2023 (90 days after the current PHE expiration date). You will still be able to provide emergency department (ED) evaluation and management (E/M), critical care, and some observation services via telehealth to Medicare beneficiaries through the end of 2023 (but that could be extended!). After those codes are removed from the list, you won’t be able to bill for those services any longer, but you are still allowed to bill office and outpatient E/M codes which are permanently on the list of approved telehealth services.

HOWEVER, although you are allowed to continue billing the ED E/M, critical care, and some observation services through at least December 31, 2023 (and perhaps longer), your ability to provide these emergency telehealth services will be limited going forward. Once the PHE ends, you won’t be able to provide telehealth services in another state unless you have a license to practice in the state where the patient is located (individual states have different state licensing requirements regarding telehealth, which must be adhered to-- and many states have already ended their licensure flexibilities). You won’t be able to use everyday applications such as Facetime and Skype to provide telehealth services. You won’t be able to provide cheaper services to certain Medicare patients in need by deciding not to collect their co-payments, coinsurance, and/or deductibles. You also won’t be able to prescribe buprenorphine for the treatment of opioid use disorder via telehealth unless the Drug Enforcement Administration (DEA) issues a reg that makes that flexibility permanent.

Thanks to Congress continuing to waive the originating site and geographic Medicare restrictions, you will be able to provide telehealth services to Medicare patients no matter where you or your patient are located (as long as you are in the same state) through the end of calendar year (CY) 2024. Then, starting on January 1, 2025, Medicare telehealth will return to a rural-only benefit, so you won’t be able to provide these services in urban areas. Your Medicare patient must come into an originating site—like a hospital—to receive these services and can no longer receive a telehealth service from their home.

Confusing enough? Here is a table that should help clarify things.

|

Covid Telehealth Flexibility |

Expire at the End of the PHE |

Extended Permanently Past the PHE |

Extended for 151 days past the end of the PHE* |

Extended to End of CY 2023* |

Extended to the End of CY 2024 |

Who Has the Authority to Extend Further or Make permanent? |

|

Certain Emergency Medicine Codes on List of Approved Medicare Telehealth Services (ED E/M, Critical Care, and Some Observation Codes) |

|

|

X |

|

CMS |

|

|

Other Codes that are Temporarily added to List of Medicare Approved Telehealth Services |

|

|

X |

|

|

CMS |

|

Certain Medicare Supervision Requirements |

|

X |

|

|

|

CMS |

|

Mental Health In-Person Requirements |

|

|

|

|

X |

Congress |

|

OUD Treatment Telehealth Policies |

X |

X (Proposed only for OTPs) |

|

|

|

DEA/SAMHSA |

|

Medicare "Geographic" and "Originating Site" Requirements |

|

X |

Congress |

|||

|

State Licensing Requirements |

X |

|

|

States and Congress |

||

|

HIPAA Waiver |

X |

|

|

Congress |

||

|

Medicare Beneficiary Cost-Sharing

|

X |

|

|

Congress |

||

|

EMTALA Policy Regarding MSEs |

X |

|

|

CMS |

||

|

All Medicaid Policies |

X |

|

|

States |

||

|

All Private Insurer Policies |

X |

|

|

Private Insurers |

* Will likely be extended longer by CMS given that Congress has extended many of the telehealth waivers through the end of CY 2024.

All in all, the telehealth landscape is still in flux, since we do not know exactly when the COVID-19 PHE will end, and CMS will more than likely issue new regulations to align its telehealth policies with those included in the Consolidated Appropriations Act, 2023. In other words, although the ED E/M codes, some observation codes, and other codes are currently set to be removed from the list of telehealth services at the end of CY 2023, CMS may decide to keep these codes on the list until at least the end of CY 2024 to better align with Congress’ extension of the Medicare originating site and geographic restriction waivers. We will be watching out for a CMS reg in the next couple of months.

Medicaid Coverage

There is a significant concern that millions of people will lose their Medicaid and Children’s Health Insurance Program (CHIP) coverage sometime over the next year. To ensure that lower-income Americans received the care they needed during the pandemic, Congress, through the Families First Coronavirus Response Act (FFCRA), provided additional federal support to states that expanded and were able to maintain their Medicaid and CHIP rolls. Nearly all states took advantage of this increased “Federal Medical Assistance Percentage (FMAP)” in some form—leading to a significant increase in overall Medicaid enrollment.

Once the higher FMAP goes away, states will become responsible for more of the cost of caring for this population. States undoubtedly will need to re-evaluate who will remain eligible for Medicaid as they “unwind” from the PHE and go back to traditional Medicaid and CHIP operations and funding levels. To help states with this “unwinding process” and to ensure that there is a reasonable process in place for reassessing Medicaid eligibility, CMS issued guidance to states that specifically lays out a 12-month time period for making these eligibility re-determinations. In the guidance, CMS states that it “will work with states and provide continued technical assistance to ensure they are able to restore routine operations in a manner that promotes continuity of coverage for eligible individuals and seamless coverage transitions for those who become eligible for other insurance affordability programs.” CMS is hopeful that some of the people who will be cut from Medicaid will be able to enroll in the Affordable Care Act (ACA) Exchanges.

The enhanced FMAP was initially set to expire at the end of the COVID-19 PHE, but in the Consolidated Appropriations Act, 2023, Congress allows states to begin processing Medicaid redeterminations April 1, 2023 (i.e., perhaps before the COVID-19 PHE ends), while phasing down the higher FMAP. That means that some of your patients who are currently on Medicaid could lose that coverage sometime in 2023. Unfortunately, I wouldn’t be surprised to see an uptick in the number of uninsured individuals by the end of the year.

The Start of the Post X-waiver World

As I’m sure you’ve heard by now (and as Ryan McBride relayed to you in last week’s regs and eggs)—Congress has repealed the “X-waiver” requirement for prescribing buprenorphine (and other narcotics) for the treatment of opioid use disorder (!!). This is a policy change that ACEP has been pushing for years, and therefore is a major victory. Congress also created a new requirement for clinicians to receive eight hours’ worth of training related to dispensing controlled substances as a condition of receiving or renewing their DEA licenses (with certain exceptions). This new training requirement becomes effective 180 days after the enactment of law (June 27, 2023: 180 days after December 29, 2022).

Given that the X-waiver requirement has been around for a while, naturally there are a lot of questions about what these changes mean for you. As Ryan stated last week, we are waiting for the Substance Abuse and Mental Health Administration (SAMHSA) and the DEA to release guidance that will effectuate these changes and answer some outstanding questions. Some of these questions include:

- When can clinicians without a DEA X-waiver begin prescribing buprenorphine?

- Does the eight hours of training refer to cumulative eight hours of training on addiction or a specific 8-hour course? Could clinicians fulfill this requirement with eight hours of continuing medical education on addiction that is not one cohesive course?

- Is any clinician who currently has an X-waiver exempt from the training requirement irrespective of when they did the traditional 8-hour course? What happens if a clinician received an X-waiver in the last year and a half when the Biden Administration effectively eliminated the 8-hour training requirement?

- Who can offer the training, and how can an organization get the training approved/certified?

- How do clinicians show to the DEA that they completed the training? Will there be an attestation process, or will clinicians need to provide documentation?

I know you are all eager to get these questions answered! Hopefully, the guidance will be released shortly, and it will answer all these questions (and more!). However, even after the guidance is released, I’m sure more questions will pop up. Another complicating factor is that states have their own laws regarding dispensing controlled substances which you still will have to follow. Thus, we likely will have to spend a lot of 2023 trying to figure out the right rules and procedures in a post X-waiver world.

The Ongoing Saga of Medicare Payment Cuts

This issue obviously is not new, but again will be a focal point of our reimbursement advocacy this year. With the passage of the Consolidated Appropriations Act, we are looking at a 2 percent cut to the Medicare Physician Fee Schedule (PFS) conversion factor in 2023 and a looming 1.25 percent the following year. On top of that, CMS could propose additional changes to the values of PFS codes each year that, due to the budget neutrality requirement, could cause the cuts to be even higher.

ACEP has repeatedly argued that these cuts to physician payments will create significant access issues going forward. We will have to continue the fight to stabilize Medicare reimbursement with CMS and look forward to working with Congress to see if 2023 is finally the year when Congress will enact some meaningful physician payment reform.

Dealing with No Surprises Act Policy and Operational Issues

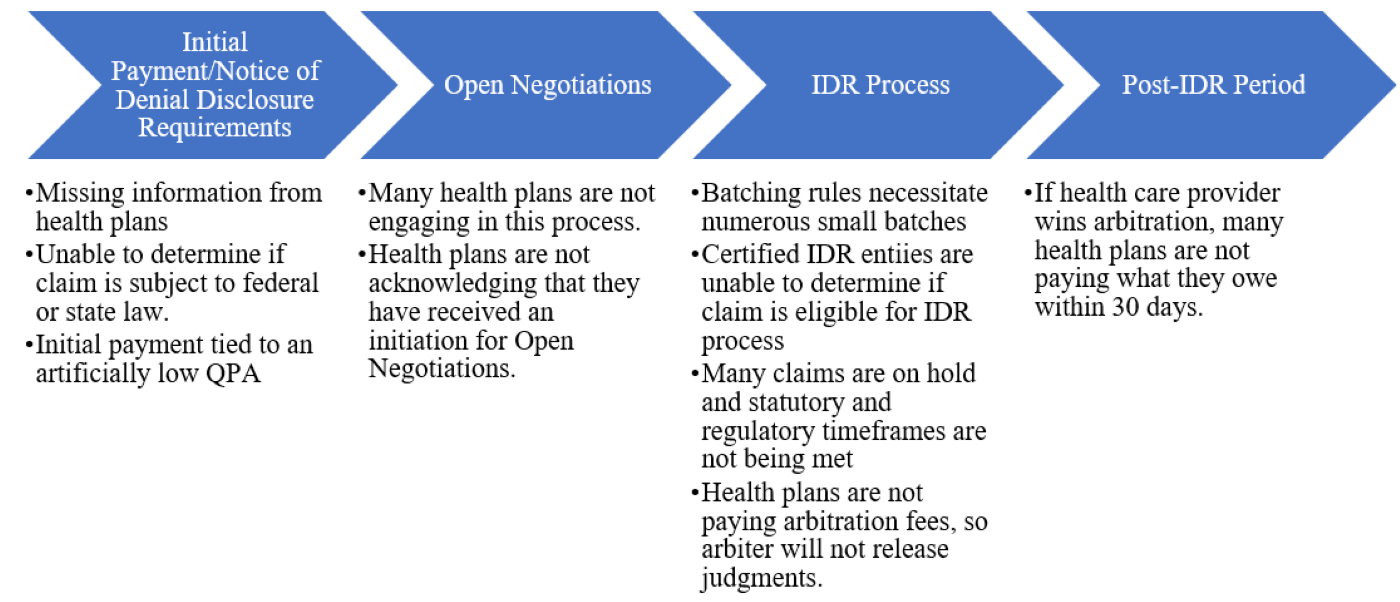

Unfortunately, there have been numerous issues with the way the Departments of Health and Human Services (HHS), Labor, and Treasury (the Departments) have implemented the No Surprises Act, especially around the construction and execution of the dispute resolution process. These issues have been raised repeatedly by ACEP and other organizations, but in many cases, remain unresolved.

As one can see from the chart below, there are issues at every stage of the dispute resolution process, from the disclosures that health plans are required to provide at the time of the initial payment or notice of denial, to the Open Negotiations and independent dispute resolution (IDR) processes, and ultimately to post-IDR period. Throughout each step of the process, there is a perceived lack of enforcement of all the statutory or regulatory requirements, thereby allowing these issues to remain ongoing and unchecked, with little recourse to the party that is not complying with the requirements.

Perceived little to no enforcement to make sure that

all dispute resolution process requirements are met.

Along with these issues, the actual cost of the IDR process is increasing significantly in 2023. The Departments not only announced a 40 percent increase to the maximum amounts that certified IDR entity fees could charge in 2023, but also just recently announced a 600 percent increase (!!) in the administrative (non-refundable) IDR fee that the Departments charge—from $50 to $350. This will make the IDR process inaccessible to many small groups and is truly unacceptable!

In all, there is a downward spiral chain of events that is having catastrophic impacts on physicians—especially safety net physicians in rural areas. Physician groups are first being driven out-of-network, then are receiving an initial payment that is artificially low, and finally are unable to receive a fair payment for services since the federal dispute resolution process is prohibitively expensive and simply not working. Many small and medium-sized practices are on the verge of bankruptcy—which will lead to even more provider consolidation. Soon even the larger groups will be forced to band together to keep afloat. In the end, this all will result in significant gaps in access to vital care for patients across the country.

The IDR process is broken—and ACEP has been working hard and will continue to work throughout 2023 on these issues and raise others with the Departments as they arise. Our work in 2023 actually starts today, when ACEP and other organizations meet directly with CMS to try to improve the dispute resolution process.

Besides these implementation concerns, there are also multiple unresolved policy issues. First and foremost, the Texas Medical Association (TMA) has a second lawsuit against the Administration challenging the flawed double counting provision that was included in the No Surprises Act final reg. ACEP supports this lawsuit, and if the TMA is successful (which we should find out within the next couple of months), the Administration may rescind the policy.

Finally in 2023, we expect to see the Departments issue regs on some of the provisions in the No Surprises Act that have not yet been implemented, including the requirements for health insurers to display the out-of-network deductible on their enrollees’ insurance cards, to routinely update their provider directories, and to provide an advanced explanation of benefits to their enrollees so that patients understand the cost of their scheduled care ahead of time.

The Ramp Up of the Merit-based Incentive Payment System (MIPS)

As discussed in a previous Regs & Eggs blog post, 2023 is a big year for MIPS, the major quality performance program for physicians in Medicare. Due to the COVID-19 public health emergency, hardship exemptions have been in place for the 2019, 2020, 2021, and 2022 MIPS performance periods. Therefore, for some of you, 2023 may be the first time you participate in MIPS in four years.

MIPS participation can have a significant impact on your overall revenue! The maximum negative payment adjustment in 2025 (based on performance in 2023) is a reduction of 9 percent on your Medicare covered professional services. And CMS is making MIPS more and more challenging each year. There a high-performance threshold (the point score out of 100 you need to achieve to avoid a penalty and receive a bonus) of 75 points in the 2023 performance year, meaning that you have to perform extremely well across the different categories of MIPS to receive any type of bonus and avoid a penalty. It is also the first year of a new reporting option in MIPS called the MIPS Value Pathways (MVPs)—and there is an emergency medicine MVP that we encourage you to try out.

While you should definitely start thinking about how best to meet the MIPS performance requirements for performance year 2023, you also still have some time to think about whether you want to report data for the 2022 performance period or apply for a hardship exemption due to the COVID-19 PHE. CMS announced on December 29, 2022 that clinicians can continue to apply for an exemption from all four MIPS performance categories (Quality, Cost, Improvement Activities, and Promoting Interoperability performance categories) until March 3, 2023. Even if you submit an application, you or your group still have the option of submitting data in two or more performance categories and receiving a performance score. If you do choose to submit enough data to receive a score, your exemption is overridden. For more information on submitting a hardship exemption for the 2022 performance period, please go to CMS’ website here.

So, these are the top five regulatory areas that are on my radar for now—and there are plenty of others as well (42 CFR Part 2 revisions, Medicare Advantage overpayments, violations of the prudent layperson standard, to name a few)! As these and other issues evolve and there are updates, you can rely on Regs and Eggs in 2023 to keep you informed!

Until next week, this is Jeffrey saying, enjoy reading your regs with your eggs!